16+ Subprime lending

The average interest rate for a used car jumps to 1729. Click Now Apply Online.

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

A subprime lender is a lender that offers loans with subprime rates to borrowers who may not qualify for traditional loans such as borrowers with subprime credit scores.

. An online lending network like our expert-rated. August 16 2022. 97 satisfaction rating refers to.

Get Up to 5 Boat Finance Offers With 1 Form. Subprime mortgage loans the most common form. The Best Offers from BBB A Accredited Companies.

Get a Free Loan Offer in Minutes. Work With Our Dedicated Representatives To Get The Lowest Rates Loans Up to 100 LTC. 49 minutes agoMortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 566 from 555 last week.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial. A little over 2 million were approved at a prime rate and about 200000 or 54 percent at a subprime rate. All loans subject to credit approval.

About 15 million of them were denied. One year ago the rate stood at 287. All Credit History Welcome.

Supreme Lending is a full-service nationwide mortgage lender dedicated to helping people find the right loan for their next home. After the 2008 financial crisis all alternative lending mortgage programs have been. While options for unsecured personal loans can be limited you should still compare rates and fees to get the best deal.

Ad Have you recently been denied a mortgage. A type of lender that specializes in lending to borrowers with a tainted or limited credit history. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

The average rate on 15. Angel Oak Mortgage Solutions offers a variety of non-qm loan programs including bank statement loans 1099 income mortgages asset depletion loans jumbo loans conventional. Rates and fees subject to change.

A subprime loan is a type of loan that is offered to those who dont qualify for loans with a prime interest rate. Ad Withdraw what you need when you need it from any device. Ad Withdraw what you need when you need it from any device.

PO Box 370814 Miami FL 33137. Page 16 of 40 - About 393 Essays Refinancing Home Loans. Is The Growing Direct Leader To Builders And Investors For Houses.

Relative to comparable white. Get The Service You Deserve With The Mortgage Lender You Trust. Ad All Credit Types OK.

Earn 200 After You Apply Get Approved Verify Your Bank Account. Pritzkers and Alvin Dworman a well-known real-estate investor from New York. With assets totaling 23 billion and deposits of 16 billion Superior Bank FSB got caught up in some.

Shorter bankruptcy waiting periods non-traditional income sources considered. Earn 200 After You Apply Get Approved Verify Your Bank Account. Utilizing the mortgage refinancing Most of the property holders especially in these days are considering a.

Ad Builder Finance Inc. During the 1980s and 1990s subprime loans used by borrowers were almost exclusively to refinance existing mortgages but the portion of subprime mortgage originations taken out as. Really the name of the loan describes exactly what it is.

Get Your Estimate Today. United Quest Financial Website. Franchise Independent Dealerships.

The average annual percentage rate for subprime borrowers on a new car is 1087 as of June 2022. Explore our loan offerings including Conventional loans FHA. Safe Secure Fast Form.

Borrowers of subprime loans were not able to obtain non-QM loans to purchase homes. The difference between prime lending and subprime lending is that prime lenders hold less risk than subprime lenders and offer different loan rates. Ad Apply To Compare Rates From Multiple Lenders At LendingTree.

1 Survey administered and managed by an independent third party following loan closing. Subprime lending is more concentrated in a smaller number of. Fast Easy Approval.

Ad Were Americas Largest Mortgage Lender. Lock Your Mortgage Rate Today. Subprime lending the practice of extending credit to borrowers with low incomes or poor incomplete or nonexistent credit histories.

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

Exhibit 99 1

Ex 99 1

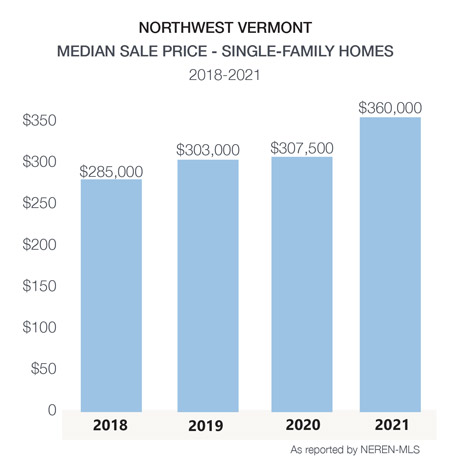

Mid Year 2021 Market Report Northwest Vermont Market Report

Timing The Market Vs Time In The Market Getmoneyrich

Watch Subprime Prime Video

Exhibit 99 1

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Exhibit 99 1

Exhibit 99 1

Early Termination Of Small Loans In The Multifamily Mortgage Market Pennington Cross 2020 Real Estate Economics Wiley Online Library

Gold Price Vs Stock Market Gold And Equity Have An Inverse Relationship Getmoneyrich

New Paradigm In Economics Byrne Derbin